By: Michael O’Farrell

Investigations Editor in Spain

A PUBLICLY funded hospice sold a €250,000 Spanish property it had received as a gift for a fraction of its value, the Mail on Sunday can reveal.

Our Lady’s Hospice (OLH) in Harold’s Cross should have made hundreds of thousands of euro after it was bequeathed the Costa Del Sol home in 2008.

But instead, the hospice took five-anda-half years to sell the poolside property – and sold it for so little that the charity actually lost €32,203 in the process.

The loss was incurred because in the half decade it took to sell the home for just €37,500, OLH paid out €69,703 in management fees and other bills, often without adequate invoices to back the payments up.

The home was later the subject of a HSE audit that found it had a value of €250,000 at the time it was sold.

Disposing of it was the responsibility of OLH’s then head of finance, Denis Maguire.

Mr Maguire was dismissed for ‘serious misconduct’ and ‘serious negligence’ in September 2016 following an independent investigation and an internal disciplinary procedure. He has since been arrested and questioned by gardaí investigating the sale.

The hospice has now launched a High Court case against him. Mr Maguire, meanwhile, has recently transferred his family home into the sole ownership of his wife and sold a number of other assets.

The Spanish property, in a gated community called Aloha Lake Village, is near Marbella in the hills above the luxury Puerto Banus marina. The community of 45 houses boasts three communal swimming pools, overlooks a mountain lake popular for family picnics, and is surrounded by several golf courses.

According to Spanish property records, No.14 Aloha Lake Village was purchased by Irish woman Agnes Phelan for €364,000 in 2004. Mrs Phelan left the home to the hospice when she died in October 2008.

Responsibility for managing the sale of the Spanish asset then fell to Mr Maguire.

As head of finance, Mr Maguire was the company secretary of OLH’s corporate entity, Our Lady’s Hospice & Care Services Ltd.

This firm receives circa €25m from the HSE each year as well as millions more from public fundraising and donations.

The sale of the Spanish property became the focus of a HSE audit after a whistleblower expressed concerns about financial affairs at OLH a number of years ago.

That audit found that the Aloha Lake Village home had never been placed on the open market by OLH, resulting in ‘a perceived unfair advantage or closed opportunity to the buyer’.

The audit concluded: ‘The property was neither sold at market value nor was it made available on the open market and therefore lacks transparency and may be perceived as failing the arms-length test and significantly reducing funds available to OLH.’

As a result, the hospice has now implenow a conflict-of-interest register a conflict-of-interest register for all executives and staff.

According to the audit, there was ‘no independent valuation sought at any time’ for the Spanish property and there was ‘no evidence of business planning for the expenditure’ incurred.

The audit found that in 75% of cases a simple request for payment resulted in funds being paid out for the Spanish home, even though invoices and purchase orders had not apparently been received.

Furthermore, because of the way the Spanish asset was accounted for, the audit team said it ‘cannot be sure all costs associated with this inheritance have been captured’.

This means the loss incurred by the charity could be higher than the €32,203 estimated by the audit.

There was also ‘no evidence in board minutes of any plan to hold on to the property until the market improved… nor was there any evidence of an agreement by the board to sell the property at the time when the sale took place.’

In the half decade that the hospice retained the home, Mr Maguire travelled to Spain on expenses six times, incurring bills of €3,620, the audit explains. Mr Maguire’s wife, Deirdre, accompanied him on five of these trips but the couple paid for her flights themselves.

The majority of these expense cheques were signed off by Mr Maguire himself and the then head of HR Audrey Houlihan, who has become CEO. One claim cheque was signed by Mr Maguire and then CEO Mo Flynn, who is now heading up Rehab, according to the audit.

It is against hospice rules for a manager to approve and sign their own expense claims. Contacted this week, former CEO Ms Flynn said: ‘I was never a cheque signatory while CEO of Our Lady’s Hospice. My remit involved approval of expenses accrued by senior staff in the normented mal course of their duties.’

The hospice has put in place new rules to ensure expenses claims must be authorised by two independent signatures. An OLH spokeswoman said this week: ‘As this matter has already been in the public domain and is subject to Garda investigation, we are unable to comment any further at this time.’

When certain details from the audit previously emerged in late 2017 and early 2018, a hospice statement was released: ‘While the majority of the audit’s recommendations focus on historical matters during 2006-2015, we have worked systematically through the findings.

They have demonstrated that the financial controls in place at that time were not sufficiently comprehensive.

‘For that, the Board and Management offers an unreserved apology. Our current Management and Board of Directors have fully taken this on-board and acted immediately to enhance our financial procedures.’

michaelofarrell@newsscoops.org

A ‘cold email’ that led to the low-cost sale of the home.

ON JULY 9, 2014, a junior member of the finance team at Our Lady’s Hospice received a ‘cold email’ from an individual purporting to be based in the US.

The email noted the address of the Hospice’s Aloha Lake Village property and offered to buy it sight unseen for €37,500.

The property was conservatively worth €200,000 more than that.

The email also referred to the property as ‘being on the market’ even though this was not the case.

According to an audit of the subsequent sale, head of finance Denis Maguire is understood to have been ‘aware of the offer and verbally approved’ its acceptance.

On July 16, Mr Maguire then forwarded the sale correspondence to the charity’s solicitor and asked them to arrange the legalities.

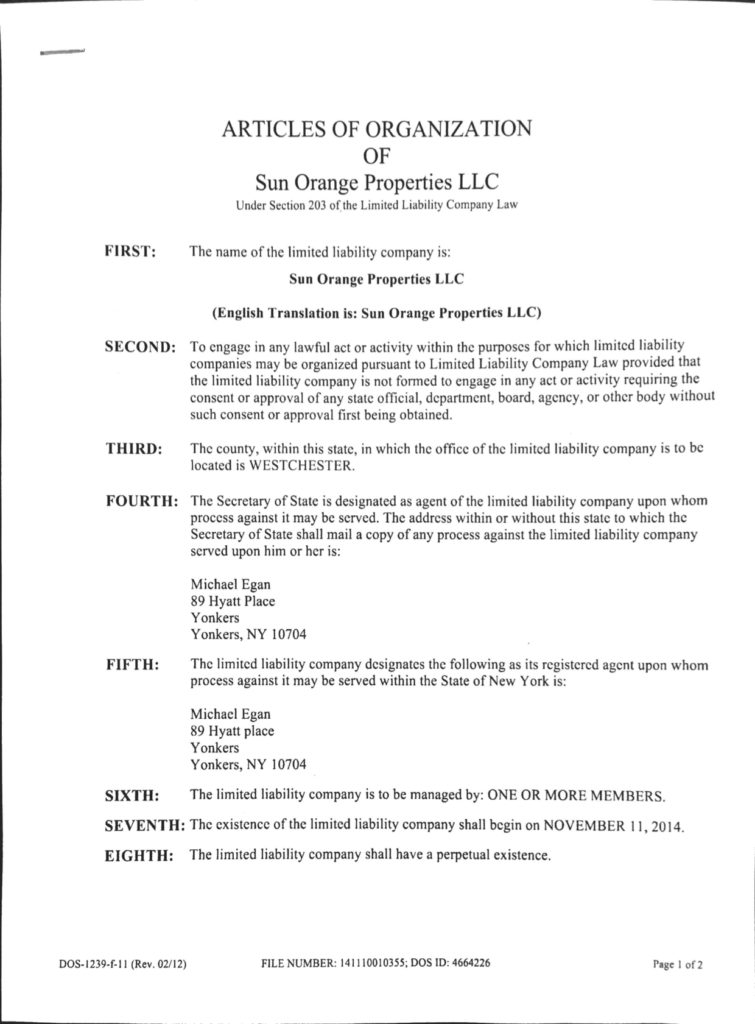

The sale went through on March 15, 2015. It was sold to a firm in the USA. This firm was established on November 11, 2014 – four months after the ‘cold email’ offer.

The audit did not name this US entity or its ultimate owner, a man who presented himself before a public notary in Dublin in order to transact the deal. But the Irish Mail on Sunday has confirmed via Spanish land records that the buyer was New York firm Sun Orange Properties LLC.

This firm, which remains the owner to this day, was set up by a Michael Egan with an address in Yonkers, New York. Mr Egan has also been named as a defendant in the High Court case being taken by the hospice against Mr Maguire.

UPDATE – THE MOS REVEALS HOW MICHAEL EGAN IS A FAMILY FRIEND OF DENIS MAGUIRE

The owners of the Yonkers address – Michael Gillespie and his wife Louise – said they had a number of tenants there but had never heard of Michael Egan or Sun Orange Properties.

The residents’ association at Aloha Lake Village also lists Sun Orange Properties LLC, care of Michael Egan, as owner of No.14. But the address given to the resident’s association for Sun Orange Properties appears to be a false or mistaken Florida address.

The contact number that the residents’ association has for Mr Egan corresponds to that of Lex-Marbella, a long-established and reputable law firm in Marbella.

When contacted by the MoS, lawyer Rodrigo Blanco said he could not ‘disclose any confidential information whatsoever about clients’. Mr Blanco said that in any property transaction his firm’s role was limited ‘to ensuring that all documentation is in order’, adding: ‘We have no say whatsoever in the price paid for a property.’

Business interests extend well beyond the hospice

Accountant Denis Maguire, 61, lives with his family just outside Glencullen in Co. Wicklow, a short walk from Johnnie Fox’s Pub.

Mr Maguire and his wife Deirdre (nee Hilliard) are prominent figures in local golfing and horse circles.

Mr Maguire was appointed company secretary to Our Lady’s Hospice & Care Services Ltd in March 2005. Aside from his job as head of finance for the hospice, Mr Maguire has had a number of other business interests, including ownership of a number of properties near the hospice grounds.

Trading as Denis Maguire & Associates, Mr Maguire continued to act as an auditor for a number of firms and organisations during his time with the hospice.

He resigned as auditor of most of these firms last year. But he continues to audit JSD Forestry Ltd, a firm controlled by his brothers John and Séamus and owned by extended family members.

He also continues to present company registration filings for the Cedar House Nursing Home Company, a nursing home run by the Society of the Sacred Heart nuns on the grounds of the former Mount Anville Convent.

In the 1990s, Mr Maguire and assorted business partners were involved in building a number of property developments including the Sandy Lane estate near Courtown in Co. Wexford and a complex of holiday homes in Co. Galway.

In 2011, Dún Laoghaire Rathdown Co. Council registered a €1,941 judgment against Mr Maguire, which was settled in 2014.

Mr Maguire also owns further properties directly across the street from the hospice entrance.

Together with his brother, Séamus – a former general manager of Schering-Plough Animal Health – he has purchased a number of additional Harold’s Cross properties since the 1990s.

These include No.66 Harold’s Cross Road, which the brothers purchased in 2008. This property, which directly adjoins the Hospice entrance and grounds, was sold for €800,000 last March.

How Finance Boss Ran Up Bill For Thousands With Spain Trips.

It took five-and-a-half years (from october 2008 to April 2014) for our Lady’s Hospice to secure title and sell the Spanish property. For two years – May 2011 to october 2013 – there was ‘little or no progress’, according to the HSE audit. As hospice head of finance, Denis Maguire was responsible for dealing with the Costa Del Sol home. He travelled to Spain on six occasions between 2009 and 2013, five times with his wife. His expenses claims are detailed here:

Trip One – June 2009.

PurPose: Meet Spanish solicitor

Cost: €973 to cover 50% of flights, accommodation and airport parking and 100% of taxi.

Trip Two – December 14-16, 2009.

Purpose: Meet Spanish solicitor.

Cost: €637 to cover 50% of flights, 100% of accommodation, taxi and airport parking. Plus mileage to Dublin Airport €92.38. Auditors say they would expect 50% of the hotel bill to be reclaimed.

Trip Three (Alone) April 30-MAy 9, 2010.

Purpose: ‘Visit to Spanish solicitor’

Cost: €436 to cover 100% of flights and car hire. No accommodation cost. Car hire costs claimed prior to trip taking place.

Trip Four – September 1-5, 2011.

Purpose: AGM of community owners.

Cost: €771 to cover 50% of flights, 100% of hotel, car hire and car insurance. Auditors noted that they would have expected 50% of the hotel bill to be reclaimed.

Trip Five – September 5-9, 2012.

Purpose: AGM of community owners.

Cost: €398 to cover 50% of flights, 100% of car hire and car insurance. No accommodation claimed.

Trip Six – September 4-9, 2013.

Purpose: AGM of community owners.

Cost: €313 to cover 50% of flights, car parking and car hire. No accommodation claimed.