THE Government has allowed a massive farming tax scam that has cost taxpayers tens of millions of euro to continue despite repeated warnings from Revenue, an Irish Mail on Sunday investigation reveals.

The tax abuse – which enables some chicken farmers to recoup as much 1,000% more VAT than they are entitled to – was first identified to the authorities in 2013 by a whistleblower.

Despite this, the Government has never shut down the scam, even though it passed a law more than six years ago to allow the finance minister to do with a single stroke of a pen.

Now this failure to act could result ireland being investigated and fined the European Commission if it is found that the Government allowed breaches EU VAT rules to continue.

Under EU directives, no business can claim more in VAT than it pays.

However, Irish poultry producers were able to earn multiples more than they paid by manipulating rules intended to make VAT administration simple for farmers.

This exploitation of what farmers call the ‘flat-rate allowance’ allowed the sector to secretly harvest unjustified VAT returns from the Exchequer.

According to a never-before published Revenue review – seen by the MoS – this tax abuse earned the poultry sector €7m more in 2017 alone, an average of €35,000 per farmer.

An MoS analysis of the underlying figures revealed in the review suggests the scam could have cost the State more than €20m in recent years.

A second element to the abuse involved VAT being harvested on the double via farming co-ops. When Revenue ordered this practice to halt in August 2017, the amount of VAT overcompensation dropped, from 1,000% to 750%.

In turn, this Exchequer funding benefited the sector’s largest processors and their multi-millionaire owners, as well as the farmers.

When the MoS first asked the Government about the widespread VAT abuse in the sector a month ago, the Department of Finance and Revenue issued a joint response.

The cryptically worded statement gave no indication of Revenue’s continuing concern over the Government’s failure to act against the tax abuses.

However, internal files obtained by the MoS under the Freedom of Information Act reveal Revenue warned the Government the tax abuse could escalate and spread to the beef sector, with far more costly consequences for taxpayers.

These concerns were reflected in correspondence between former finance minister Paschal Donohoe, now Public Expenditure Minister, to the minister for Agriculture.

Mr Donohoe wrote: ‘There is significant overcompensation of unregistered farmers in the chicken production sector.

‘Despite Revenue’s engagement with the sector, the practice continues. This is unsustainable in that the flat-rate scheme is designed to compensate unregistered farmers for the VAT paid on their inputs but overcompensation is not permitted under EU law.’

Mr Donohoe added: ‘There is also a concern that the business model and contractual arrangements that have emerged in this sector could migrate to other agricultural sectors with potentially more serious implications for VAT revenues.’

The documents also show Revenue told the Government that the millions earned via the scam likely amounted to illegal State aid.

One Revenue official noted in internal correspondence prompted by our original query a month ago, ‘The Department were also advised that should the Minister decide not to remove the sector from the op- eration of the flat-rate addition that they would need to consider the issue of State Aid’.

The files also lay bare the frustration of senior Revenue officials as their warnings went unheeded.

One Revenue official criticised the Department of Agriculture for allowing the poultry sector to ‘engineer an opportunity to stall the process and walk us into a merry go round’.

The same official also expressed frustration at the failure of the Department of Finance to act to shut down the VAT scam.

He wrote: ‘We have presented a report to the Department of Finance; it is up to the Minister to act or not.’

Another official was so frustrated at the lack of response from the department he suggested putting Revenue’s concerns on the record. He wrote: ‘Knowing as we do that nothing is likely to happen, what about putting our warning about the risks of the scheme migrating to other sectors on record?’

According to records seen by the MoS, Revenue was aware of these abuses from at least 2013, when Cavan chicken farmer Alo Mohan, a supplier to Manor Farm, raised the issue with a succession of tax officials.

Along with Mayo-based Western Brand and Cork-based Shannon Vale Foods, Manor Farm is one of the top three chicken processing firms in Ireland. Of the three, Shannon Vale Foods was the only one in which farmers did not operate a co-op.

However, the three firms have jointly made representations to the Department of Agriculture in a bid to ensure the sector is not excluded from the flat-rate allowance because of the abuse.

Mr Mohan raised his concerns after his accountant, Frank Lynch & Co, advised him that to engage in the scam would amount to VAT fraud.

A second opinion, from former Revenue Commissioner and tax adviser Eugene Dolan, also advised the practices would amount to, ‘a clear misuse/abuse of the VAT input credit regime and indeed of the VAT system in general’.

Despite these concerns, a number of Revenue officials were unable to clarify for Mr Mohan if the schemes were illegal.

Refusing to partake in the abuse on moral grounds, Mr Mohan ultimately lost his business. He is currently seeking to sue the Revenue for malfeasance.

In recent years, Mr Moran has also been joined in his campaign by Raymond O’Hanlon, former managing director of Cappoquin Chickens, which went bust as rivals abused the tax system to gain an advantage.

Internal Revenue and Department of Finance records confirm that, from at least 2015, the Government knew these practices were a likely breach of EU rules.

The records describe the abuse as ‘an anti-avoidance issue’ and as being ‘against the spirit and purpose of the EU VAT directive’.

In 2016, then MEP Marian Harkin made an official complaint about the practice to the EU’s director general for finance.

Briefing notes prepared for then finance minister Michael Noonan explained that ‘models are established in some sectors which result in a much higher level of flat-rate addition payments in the sector than would otherwise be available’.

Mr Noonan’s briefing notes also warned: ‘This would have implications for VAT neutrality and possibly competitiveness within the sector and within the agriculture industry generally.’

However, any EU concerns about the VAT abuses were satisfied when Ireland passed legislation to address the issue in January 2017.

The new law gave the finance minister the authority to exclude an agricultural sector from the flat-rate system completely if it was found to be abusing the rules.

Satisfied with this, the EU closed the investigation it had opened on foot of Ms Harkin’s complaint.

However, neither Mr Noonan nor his successors as ministers for finance have used this power to shut down the VAT abuses.

In September 2019, Mr Mohan and his accountant wrote a letter to Minister Donohoe, in which they said the Government had ‘failed to address or seek redress in any meaningful way’.

The letter reads: ‘What your predecessor [Mr Noonan] actually allowed for was a situation where one industry? claims more flat-rate VAT than it is entitled to compared to VAT-registered enterprises.

‘An example of this has been occurring in the large beef feed lots whereby the VAT claimed by these industrial farmers is far in excess of the inputs actually incurred and gives them an unfair competitive advantage against their farming neighbours.’

However, like his predecessor, Mr Donohoe did not use his power to ban the poultry sector from the flat rate allowance.

Mr Donohue did ask for an exclusion order to be prepared, but he never signed it after the Department of Agriculture became involved.

Asked about the VAT abuse when he appeared before the Dáil spending watchdog in November 2019, Revenue chairman Niall Cody admitted, ‘There is no doubt that, within the poultry sector, the pricing structure allowed for an overcompensation of the VAT for some people who are in that trade’.

When asked what solution was available to the finance minister, Mr Cody replied, ‘To remove the flat-rate compensation for the sector’.

Mr Cody added Revenue had conducted a detailed report ‘to establish if there was overcompensation in the poultry sector’ for the finance minister.

‘We have sent our report to the Minister for Finance. It is now with the minister and he has to consider,’ he said at the time.

He also acknowledged concerns the issue could have spread into the beef sector, saying Revenue would be ‘keeping an eye on it’.

When Aontú leader Peadar Tòibín raised the tax abuses in the Dáil in 2021, he questioned Agriculture Minister Charlie McConalogue about what he described as the ‘VAT fraud’ and ‘illegal State aid’.

However, Mr McConalogue refused to engage with Mr Tòibín, saying it was not ‘appropriate’ to raise the matter ‘on the floor of the House [Dáil]’.

Canny brothers who made fortunes out of chicken feed

THE year of 2003 was a difficult one for Vincent Carton and his brother Justin.

After eight generations their family business, Manor Farm chicken, was in trouble.

‘Everything continued to go well, until 2003, but that year the company hit a real crisis,’ Vincent told an interviewer in 2015.

That was also the year farmers supplying Manor Farm were encouraged to deregister from VAT en masse.

The move was part of the rollout of an ingenious ‘tax abuse’ scheme designed to secretly channel millions from the exchequer into the poultry sector.

Aside from Manor Farm and the Carton brothers, other chicken processors including Mayo-based Western Brand and Cork-based, Shannon Vale Foods also benefited from the scheme.

These firms – the three largest processors in the country – have all used offshore structures to keep their finances secret.

But their turnover is massive. Before going offshore in 2008, the Carton Brothers were turning over €117m annually.

Western Brand, owned by Eugene Lannon from Ballyhaunis, Co Mayo, turned over €106m the year before it went offshore in 2019.

Every week, 750,000 Western Brand chickens are packaged in the firm’s famous ‘Just Good Honest Chicken’ logo.

Shannon Vale, owned by the O’Regan family from Clonakilty, processes 120,000 chickens weekly.

And in 2017, the Carton brothers, no longer struggling as they had been prior to the VAT scams being introduced, were able to cash out for €70m.

Their buyer, Swedish giant Scandi Standard, paid the brothers €34m in cash, with the balance in shares.

The firm was sold the same year that a new law empowering the minister for finance to eliminate the poultry sector’s VAT scams with the stroke of a pen came into force.

At the time it looked as if the game was up, just as the brothers cashed in their chips.

When the MoS contacted Vincent and Justin Carton in recent weeks, the brothers did not want to discuss the VAT abuses or the timing of their decision to sell up.

Justin told us: ‘It will be Vincent who has to respond because obviously when we sold out of the company we are under restrictions, even still, as to what we can and cannot say.’

Vincent said: ‘I’m struggling to even remember the technical detail. I know it was about VAT. That was the big issue wasn’t it?’

He then asked to go off the record, after which he was able to demonstrate considerable familiarity with the issue.

We later sent the Carton brothers a detailed breakdown of the potential contents of the findings of the MoS investigation, but they declined to respond.

Western Brand owner, Eugene Lannon, said farmers’ VAT arrangements were nothing to do with him.

‘We didn’t do that system – it’s the farmers who did the system. Western Brand didn’t tell our farmers to deregister,’ he continued. ‘They decided to deregister, so I don’t know why you’re coming to Western Brand.’

Asked about the second level of VAT abuse conducted via co-ops, Mr Lannon said: ‘I don’t like co-ops. I like to deal with people individually. It was the farmer’s choice to open the co-ops.’

In response to queries from the MoS, Shannon Vale Foods said it ‘has fully co-operated with Revenue and Department on this matter and at no time has the company been found to be acting fraudulently’.

A spokesperson added: ‘The farmers who supply us are individual families who have never supplied chickens to Shannon Vale through any form of co-op structure or been involved in the so called “double VAT”.’

‘Doing nothing is not an option’. That was Revenue’s stark warning from 2019… but doing nothing has been the only political response

REVENUE’S investigation into VAT abuses in the poultry sector pulled no punches.

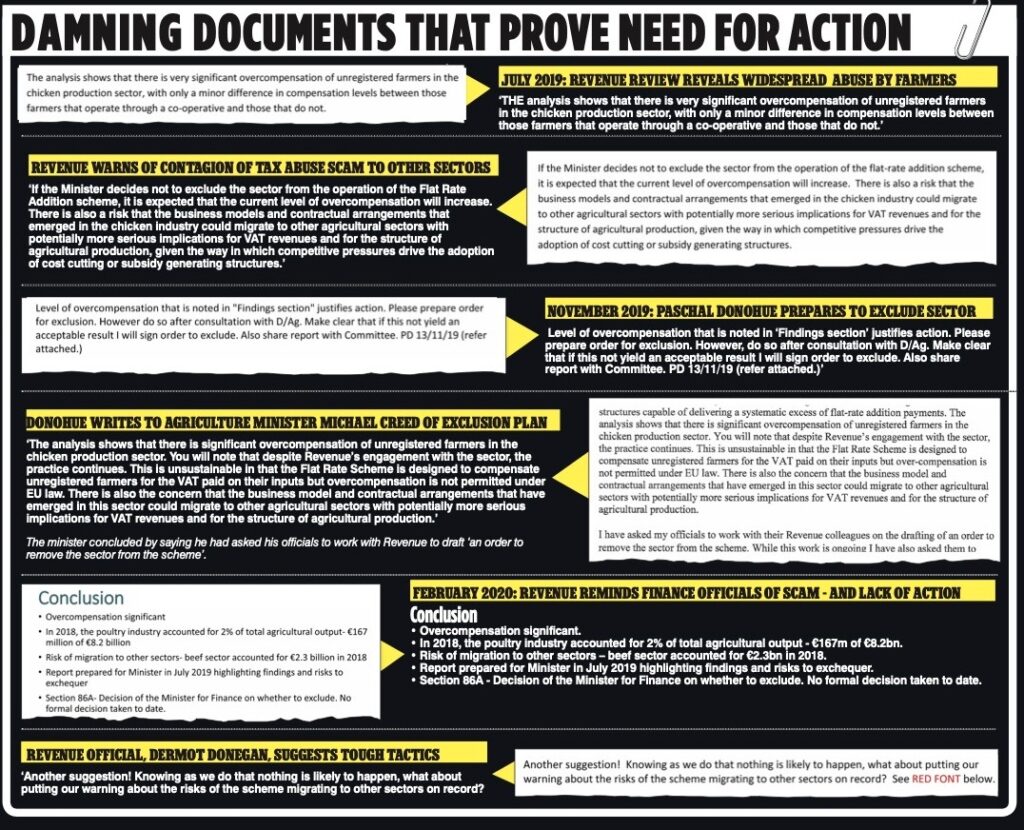

Details of the review, completed in July 2019, were obtained by the Irish Mail on Sunday under the Freedom of Information Act.

It concluded: ‘There is very significant overcompensation of unregistered farmers.’

The investigation found a sample of 80 farmers had together paid VAT worth €350,000 in 2017 – but successfully reclaimed nearly €2m back by manipulating the system.

When extrapolated across the sector, Revenue calculated that as much as €7m a year was being improperly diverted from the coffers of the State to an industry whose millionaire leaders regularly feature on rich lists.

Something had to be done and Revenue believed it would be – especially since the Government had passed a law a year earlier to allow the Finance Minister to exclude any sector abusing VAT rules from the flat rate allowance (FRA) scheme.

Revenue warned: ‘If the minister decides not to exclude the sector from the operation of the flat-rate addition scheme, it is expected that the current level of overcompensation will increase.’

When he reviewed the report in November 2019, then Finance Minister Paschal Donohoe did not hesitate. ‘Level of overcompensation? justifies action,’ he noted. ‘Please prepare order for exclusion.’

The news was welcomed by those in Revenue. ‘Good news,’ Dermot Donegan, Revenue’s Head of VAT Policy and Legislation, told colleagues.

He added: ‘The Minister is fully agreeable to signing the exclusion order for Chicken Farmers but he’d like a meeting with Agriculture to be held before this happens. If it is a case that Agriculture can’t do anything, he will sign the order.’ However, it is clear from the documents Mr Donegan was dubious Agriculture could do anything.

‘The over-compensation is occurring due to the structures, schemes, pricing and exclusivity contracts in place,’ he wrote.

The following day, the Department of Finance emailed Revenue’s findings to Sean Bell, the chief economist in the Economics and Planning Division of the Department of Agriculture.

Shortly afterwards, Mr Donohoe wrote to then Agriculture Minister, Michael Creed, saying: ‘You will note that despite Revenue’s engagement with the sector, the practice continues. This is unsustainable in that the Flat Rate Scheme is designed to compensate unregisfearstered farmers for the VAT paid on their inputs but overcompensation is not permitted under EU law.’

Mr Donohoe said his officials were drafting ‘an order to remove the sector from the scheme’.

Soon, the Department of Agriculture was in talks with the poultry sector and Irish Farmers Association representatives who said ‘significant changes’ had been made and more would follow.

Upon hearing this, Revenue officials were ‘sceptical of the industry’s capacity to change’.

Gerard Moran, an Assistant Secretary within Revenue’s Indirect Taxes Policy Division expressed his in writing.

‘This is what I was afraid of – that this further consultation would engineer an opportunity to stall the process and walk us into a merry-go-round of incremental changes and repeated labour-intensive examinations of the operation of the FRA in the sector,’ he told colleagues on January 9, 2020.

‘We have acted under the legislative provision enacted to deal with this matter and presented a report to the Department of Finance; it is up to the minister to act or not and the Department can engage with whoever it wishes on the matter and ultimately make whatever recommendation it chooses. I see no further role for us in this process other than to prepare the draft exclusion order for the minister.’

Weeks later, on January 22, the leaders of the three main processors Manor Farm (Carton Bros), Western Brand and Shannonvale Foods wrote to the Department of Agriculture to say the abuse of the co-op double VAT system had been ‘discontinued’.

They also promised consultancy reports on how much processors and co-ops should ‘reasonably’ charge for feed – since the manipulation of feed prices was the mechanism that allowed most of the VAT overcompensation to occur.

‘We trust that you can see from the actions already taken and the action under way that the industry is fully committed to ensuring that the FRA scheme remains open to the poultry sector, as it does to all other sectors of agriculture.’

This development was greeted with further scepticism in Revenue.

‘Thanks for forwarding the email from Agriculture but we have deep concerns about where this might lead,’ Mr Donegan told the Department of Finance.

His email goes on to say that since 2016 the sector has had ‘ample time to make changes and were urged to do so’.

He pointed out that, aside from the discontinuance of the double VAT co-op scam, ‘no other material changes were implemented.’

He added that Revenue, ‘see no value in repeating the same messages to the sector that were already delivered in 2017 to little effect.’

The following month, in February 2020, Revenue presented a slideshow of their concerns to the Department of Finance.

It warned ‘doing nothing is not an option’ and identified potential repetitional risks that could ensue as a result of an EU case, media coverage or political interest.

Revenue’s view did not alter after the industry delivered reports from consultants EY and Grant Thornton in the autumn of 2020.

The Grant Thornton report argued poultry co-ops were not behaving any differently to any other agriculture co-ops and should not be unfairly discriminated against.

Two separate EY reports calculated what the industry pitched as a ‘reasonable margin’ that processors and co-ops should charge for feed.

The suggested new margin was lower than the previous price levels used to scam excessive VAT returns but Revenue were not convinced.

Revenue official Denise Corrigan said: ‘In my opinion the reports do not fully deal with the issues raised.

‘The study has been undertaken on request from the processors and there is nothing included indicating what, if any, undertaking has been given by the co-operatives.’

Mr Donegan suggested: ‘Knowing that nothing is likely to happen, what about putting our warning about the risks of the scheme migrating to other sectors on record?’ he asked.

His boss – assistant secretary Gerard Moran – liked the suggestion but ultimately decided a better strategy was to stick to the core issue of getting an exclusion order.

Consequently, Revenue’s reply to the Department of Finance warned the industry reports do, ‘not address the crucial question of the level of FRA payments relative to VAT on input costs and as such is of little relevance to the determination to be mad. If the sector is permitted to continue to operate as they do at present you may need to consider if any State Aid issues arise’.

The State aid point was made once again as recently as last month as Revenue and Department of Finance officials considered how to respond to queries from this newspaper.

‘We were not convinced that the changes made sufficiently dealt with the issue of overcompensation,’ a Revenue email dated April 21, 2023, reads.

‘We also advised Finance we would not be repeating the examination that was undertaken within the sector and had no intention of preparing further reports on the matter.

‘It remains that any action to be taken to address the issue lies with the minister.

‘The Department were also advised that should the minister decide not to remove the sector from the operation of the FRA that they would need to consider the issue of State aid.’

Six years have elapsed since the Finance Minister was empowered to exclude the chicken sector. At the time, the move was enough to head off an EU investigation.

But given the revelations of Revenue continuing concerns about the tax abuses, this may not remain the case for long.

Department took poultry farmers’ word

THE Irish Mail on Sunday first asked the Department of Finance and Revenue about VAT abuses in the poultry sector more than a month ago.

In response, they issued a joint statement on April 21: ‘The business model employed in the poultry sector did not breach Irish VAT law at the time and did not constitute abuse or fraud.’

The statement said Revenue had investigated and sent a report to the finance minister, who could act if he wished.

‘Following the Department of Agriculture’s engagement with representatives of the poultry sector, the sector presented two reports which outlined changes made to the operation of the flat rate scheme within the poultry sector, and which the sector believed addressed the concerns raised in the Revenue review. Consequently, no further action was taken on this matter.’

This means the Deptartment of Finance told this newspaper that things were okay, because the chicken farmers said they were okay. A month ago, Revenue officials disagreed with that view.

During the preparation of the response on April 21, Revenue reminded Finance that they were not convinced the changes made addressed the issue of overcompensation outlined in section 86A.