By: Michael O’Farrell

Investigations Editor

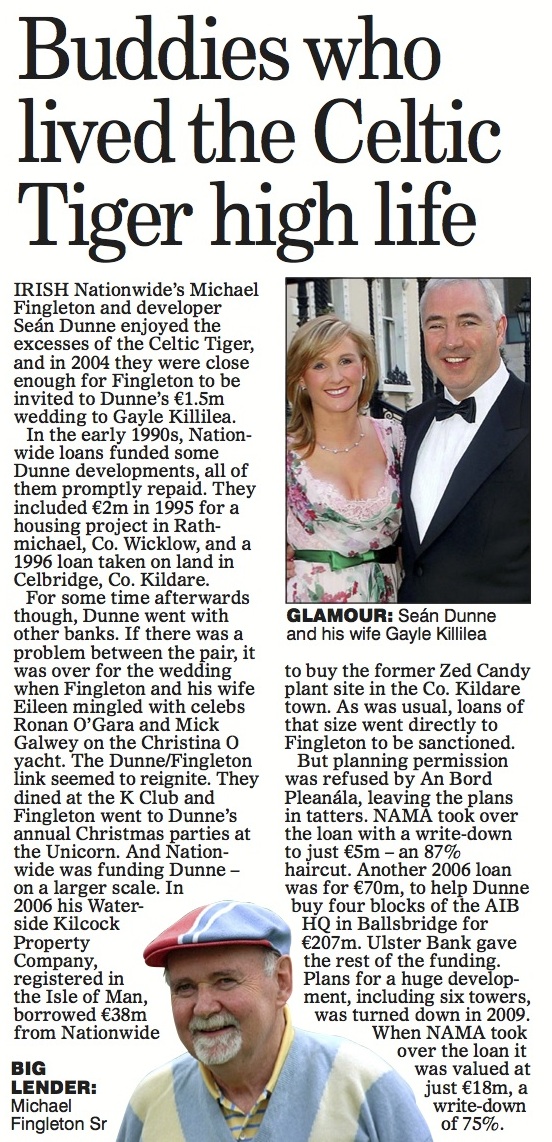

THE son of disgraced banker Michael Fingleton is the landlord of a London office block that was snapped up for £5m cash from Seán Dunne in a NAMA-approved deal last year and is now worth over £12m.

Michael Fingleton Jr’s company, Hibernian Capital Ltd, has renovated the building – PGS Court in Walton-on-Thames – and secured a £900,000-a-year, 15-year lease with Kia Motors, which will use it as its headquarters from September.

With a blue chip tenant secured, the 30,000sq.ft office building with 172 car spaces has been put back up for sale for a reported figure of £12.3m.

The ownership of the property is vested in an anonymous Isle of Man company called Kulio (IOM) Ltd.

However, an Irish Mail on Sunday investigation has found that Mr Fingleton Jr is the landlord who secured the lease with Kia.

Former Baron of Ballsbridge Mr Dunne, who applied for bankruptcy in the US three weeks ago, was forced to sell the prime real estate by Bank of Scotland and Bank of Ireland 14 months ago under a deal agreed with NAMA. Mr Dunne bought the building, in the heart of the Surrey stockbroker belt in the southwest suburbs of London, for £9.3m in 1999. He, too, held it in an anonymous Isle of Man company.

In an agent’s sales brochure in September 2009, the property was valued at £10m.

But under pressure from his creditors, Mr Dunne was forced to take a considerable hit.

The property initially failed to sell at public auction in December 2011. But immediately afterwards, Mr Fingleton Jr stepped in and took over the building, embarking on an extensive refurbishment.

Land Registry files and deeds confirm that Mr Dunne’s creditors sold PGS Court for just over £5m and that the building was bought for cash.

The transaction took place in the same month, January 2012, in which it was revealed that Michael Fingleton Sr had transferred two substantial cash amounts to the London Barclay’s Bank account of Michael Jr in 2011.

Mr Fingleton Sr switched €480,000 and €128,498 to his son’s accounts from Montenegro. The former Irish Nationwide boss had originally off-shored the money to the Balkan country days after he was hit with a €13.6m debt order by Ulster Bank.

Before he transferred the massive sums to his son, Mr Fingleton Sr claimed in a letter to Ulster Bank that he had cash deposits of just €1m.

On Friday, Mr Fingleton Sr told the MoS he had ‘no involvement financially or otherwise’ in the PGS Court transaction.

In the past two weeks, the MoS has exhaustively sought to ask Mr Fingleton Jr about the ownership of PGS Court and twice visited the registered address of his company but he has not responded to any of our questions.

However, the MoS has managed to establish that Mr Fingleton Jr’s company, Hibernian Capital, is in control of the building and it is with Hibernian Capital that Kia has agreed the lucrative lease.

The company itself is hard to pin down. There is no sign of it at its registered address nor at its previous registered address and the firm has only ever filed one set of accounts.

Mr Fingleton Jr’s name also appears on a planning application to build a further office block on part of the site.

In July 2012, the planning application was submitted to Elmbridge Borough Council in the name of Michael Fingleton. Directly underneath Mr Fingleton Jr’s name on the form, the words ‘Kulio Asset Management Ltd’ have been entered. There is no such company in either England or on the Isle of Man – but Kulio (IOM) is the name of the secret offshore company that owns PGS Court.

George McKinnia – an architect with GMK Associates – also confirmed that he had been commissioned by Mr Fingleton Jr to work on plans for the planning application.

Given that the building is now on the market, it is unlikely that Mr Fingleton Jr intended to undertake the new development himself.

However, obtaining full planning permission for further development would add significantly to the property’s market value when it is being sold.

Last night Tom Mellows, a director with property group Savills, confirmed that his company had been instructed to sell the building.

‘The only thing I can confirm is that Savills is selling the building. We’ve been instructed to sell the building,’ he said.

Savills also represented Kia Motors during last year’s lease negotiations with Mr Fingleton Jr and his company, Hibernian Capital. Savills’ building division is also doing the fit-out for Kia.

Savills formally announced the lease deal in a press release in February this year.

‘Savills has agreed terms to lease the entire office space at Walton Green, Walton-on-Thames, in its entirety from landlord Hibernian Capital,’ the press release reads.

The £907,000 annual rent works out at £29.50 per square foot. The previous highest rent achieved for the PGS Court block was £28 per square foot. When contacted by the MoS, John King, a partner and commercial director with London real estate firm Quintan Scott, confirmed that he had been instructed by Mr Fingleton Jr to negotiate the Kia lease deal with Savills.

‘We were instructed by Michael to let, in conjunction with Savills,’ Mr King said.

Asked if Mr Fingleton Jr owned the site, Mr King said: ‘Hibernian were involved in it. It’s an overseas company so I don’t know what the full set-up is but the position is thatMichael was heading the instruction, yes.

‘The position is, we dealt with the site from a letting point of view. The ownership of the site was dealt with by Michael so you need to talk to him. I don’t know anything about the ownership other than via Michael.’ However, Mr King agreed that it was accurate to say Mr Fingleton was the landlord.

‘Well they [Hibernian Capital] were our only client, yes.’ Mr King confirmed that NAMA was involved in the purchase of the property from Mr Dunne ‘because they had to sanction the disposal’.

He said: ‘Bank of Scotland also had to formally agree to the disposal of the site which was then effectively approved by NAMA as I understand it.’

Along with Mr Fingleton Jr, representatives of NAMA, Bank of Scotland and Bank of Ireland also declined to answer questions about their role in the sale of the property.

ENDS

GLOBETROTTING, FLASHING THE CASH, PARTYING HARD…AND LEAVING A FEW DEBTS IN HIS WAKE

IT SAYS a lot about Michael Fingleton Jr that he brazenly turned the bank guarantee scheme into a selling point – claiming in 2008 that Irish Nationwide was one of the safest places in the world to put deposits. Still in his twenties at the time, he was one of two executives overseeing the society’s €5bn UK loan book.

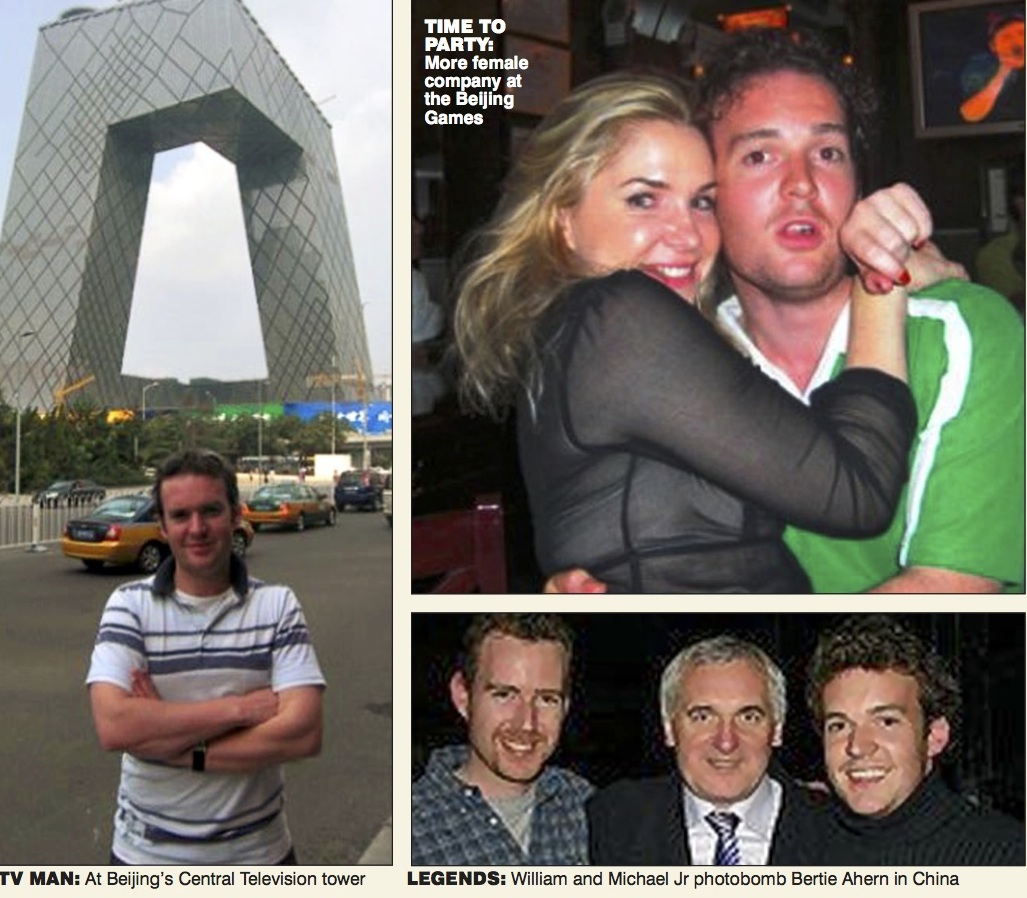

And as the Irish economy went into freefall in 2007 and 2008, Junior partied hard around the globe. Sharing their father’s confidence and bravado, Michael Jr and his older brother William even man- aged to insert themselves into a photo flanking Bertie Ahern. It has now made pride of place in a gallery of photos from China on Michael’s Facebook page. ‘Legends, each and every man,’ he wrote underneath.

Months before the Government bail-out, enjoyed a boozy and raucous trip to Beijin 2008 Olympics, where he was photographed drinking Baileys from a shoe with William, a Beijin diplomat for the EU.

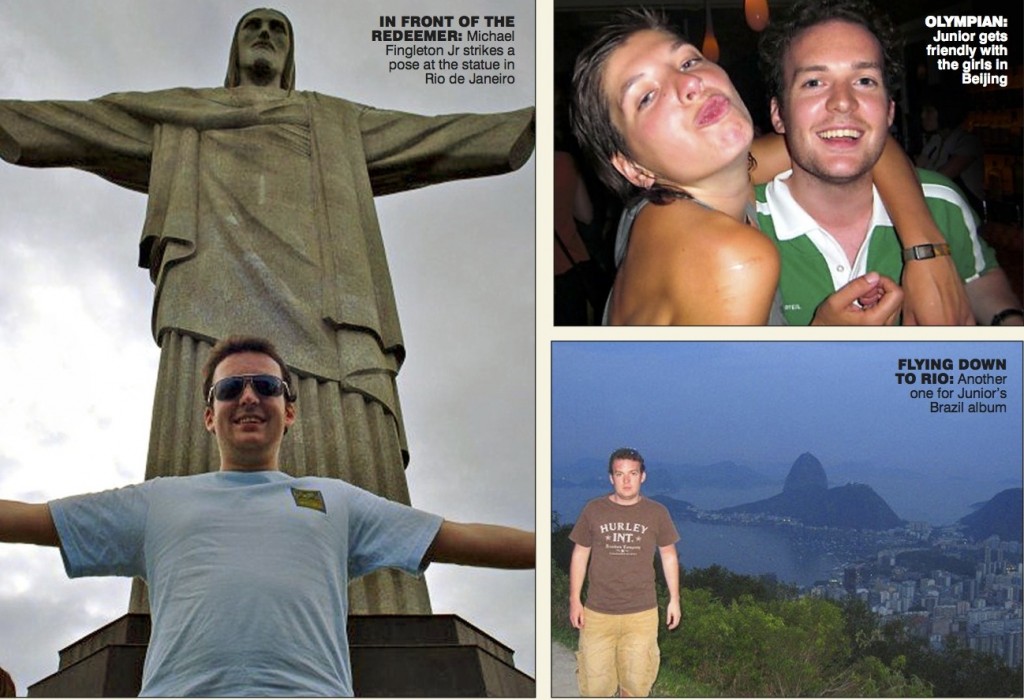

A graduate of elite private school Gonza and UCD, where he studied commerce, Junior has blazed a hard-partying trail as shown in photos from New York to Atlantic City, Brazil, Montenegro and Croatia. In other snaps, he is seen watching a bevy of scantily clad women in a New York bar during a St Patrick’s Day in 2009. Yet more shots show him carrying an unknown woman over his shoulders in a bar.

In Rio de Janeiro, he poses, arms outstretched beneath the famous statue of Christ the Redeemer.

‘If you’re saying I’m the second coming, who am I to argue,’ he quips to a friend who had indicated that the photo ‘speaks volumes’.

In December, however, his UK company Spearpoint Risk Management went into liquidation leaving unsecured debts of almost £250,000 behind.

MYSTERIOUS FINGERS JUNIOR, THE GREEK TYCOON AND HIS ELUSIVE INVESTMENT COMPANY

Michael Fingleton Jr established Hibernian Capital ltd in 2010. The firm’s website says that it has ‘significant funding available to deploy’.

But so far, hibernian has only ever posted a single set of dormant accounts.

It is officially registered on the fourth floor of No.41 Whitehall, in Westminster, around the corner from Downing Street.

Eileen Fingleton, Michael’s sister, has also registered a company, LRH consulting, at the same address. But there is no nameplate for either company anywhere inside or outside the building.

The fourth floor is occupied by a company called Concept Business Group ltd owned by Greek millionaire Nicholas Trimmatis.

‘Michael is not based here. He has never been based here. He works for me. He is based in Hanover Square. I do not know how the address for Hibernian can be registered here. Michael works for Hibernian Capital. He is based at Hanover Square,’ Mr Trimmatis said.

No.15 hanover Square is a previous registered address for Hibernian Capital but last week the landlords confirmed Mr Fingleton was no longer based there.

However, a receptionist on the sixth floor of No.41 Whitehall, in an office emblazoned with a Securisys logo, said Mr Fingleton was based there. Securisys is a group of companies owned by former Tory MP Andrew Hargreaves, who was also previously an executive of arms companies such as Daimler Benz Aerospace and the EADS Group. A woman answering the phone at Securysis said she could take messages for Mr Fingleton but could not say where he worked.

‘I do not have his business address where you could actually send something though. I am told I can receive inquiries for him through this telephone number but I do not have any other information to help you with.’

ENDS