This story was forst published in the Irish Mail on Sunday on 13/11/2011

By: Michael O’Farrell

Investigations Editor

He is famed for selling some of the most expensive petrol in Europe and his company was last week convicted of ripping off customers by using faulty pumps that delivered too little fuel. But close to nothing is known about Hugh Farrington – the secretive 47-year-old owner of the well-known Usher’s Quay service station on the Liffey in the centre of Dublin.

Until today his photo has never appeared in any newspaper despite the company’s conviction and a 2007 furore over the exorbitant price of his fuel.

In 2007 Mr Farrington’s prices were so high – up to 30 per cent more per litre than the average – that the chief executive of his own supplier, Topaz, even told the public not to buy from him.

‘We think it’s too high. I wouldn’t buy petrol there,’ Topaz’s Danny Murray said at the time.

‘We don’t agree with somebody charging that price. It’s too much.’ Later that year Topaz decided not to renew its contract with Mr Farrington citing ‘dissatisfaction with this station’s exorbitant pricing policy’.

In his only public comment, Mr Farrington said at the time the decision to part with Topaz had been his.

‘We chose not to exercise an extension ‘We chose not to exercise an extension to the current supply agreement with them,’ he said, adding that all of his prices were clearly displayed.

Not displayed though was the luxury millionaire lifestyle that Mr Farrington’s petrol business contributed to.

For the first time today a MoS investigation can reveal the details of the extraordinary wealthy and privileged world in which Mr Farrington lives.

That world includes a portfolio of properties in upmarket locations throughout Dublin and even extends to a private plane which Mr Farrington – a prize-winning pilot – likes to fly to air rallies in locations such as Guernsey.

A world away from his busy Usher’s Quay station forecourt, which has seen countless robberies and even a vicious murder, Mr Farrington and his wife, Sheryl, can choose between several multi-million euro properties in Dalkey which they own.

One of the homes – a waterside property with its own slipway into Dublin bay – is famous in rock ‘n’ roll folklore as the location where U2 recorded part of their Achtung Baby album and wrote the classic hit song One.

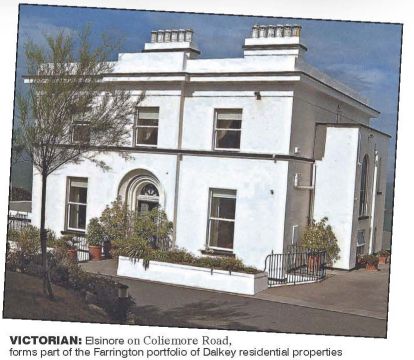

The Victorian home – Elsinore on Coliemore Road, Dalkey – fetched a record price of €5.97million when it was sold in 2000 and before it was later acquired by the Farringtons.

Lavishly refurbished in the 1990s, the 557sq metre, six-bedroom, listed property boasts three reception rooms at hall level, including a double drawing room overlooking the sea.

In 2007, the Farringtons applied for planning permission to add a conservatory and they are listed as living there in the latest electoral register.

However, they list another prize apartment nearby as their address for company registration purposes.

With stunning views across the sea, the apartment at Dalkey’s gated Kilmore Bailey View complex is not the final Farrington property in the upmarket seaside village.

They also own another Dalkey apartment in Berwick House on Coliemore Road and a luxury house at Tempe Terrace on Rockfort Avenue A 371sq metre refurbished Victorian home, the Tempe Terrace property was valued at more than €2million for auction purposes in 2003.

Also overlooking the sea, the home features an extended garden room and impressive reception rooms.

Despite all the seafront property Hugh Farrington actually has a passion for the skies – as demonstrated by his interest in a €200,000 private plane.

Purchased in 1998 with an Anglo Irish Bank loan, the Cessna 182S Skylane is owned by Westpoint Flying Group Ltd.

The company previously owned another aircraft – a Reims Aviation Hawk XP.

Mr Farrington resigned as a director of this company in the summer of 2010 but has always been the majority shareholder. Other shareholders include prominent Dundalk personality, Stephen Burns.

A one time chairman of Dundalk Urban District Council and Dundalk Football Club, Mr Burns is a jeweler and diamond dealer who shares Mr Farrington’s passion for flying.

For reasons unknown, Westpoint Flying Group Ltd – together with a number of other Farrington companies – was allowed to lapse before being reinstated to the company register after a successful application to the High Court in 2002.

But the lapse and any controversy surrounding his petrol prices have not dinted Mr Farrington’s aviation skills.

As recently as 2009 he was crowned overall rally winner at the Guernsey Air Rally, an annual gathering where millionaires and aviation enthusiasts rub shoulders to party and fly.

That year, during a fancy dress hangar ball, a beaming Mr Farrington was also presented with a glass tankard as the winner of the spot landing category.

ORIGINALLY from Kildare, Hugh Farrington is part of the well known Farrington grain and animal feed dynasty whose premises was located in the small rural village of Rathcoffey.

Founded by family patriarch, Thomas Farrinton, in the 1950s, the business initially prospered, allowing Tom Farrington to buy up a substantial property portfolio in Dublin.

Since 1970, properties that he acquired included substantial Georgian and Victorian houses in locations such as Pembroke Road, Ballsbridge and Eccles Street, where he bought number 66 – the long-time Dublin HQ of controversial guru Tony Quinn.

Decades later these properties would launch the Farrington sons – Hugh and Richard – when they took over in the 1990s.

Initially the brothers were close, sharing the same Pembroke Road address and describing themselves as landlords in company filings.

After forming a city centre restaurant company called Puerto Bello – that never appears to have traded – they began operating the petrol station and car park at Usher’s Quay.

Soon enough though – and for reasons never revealed publicly – the brothers fell out bitterly, causing a split in their family empire.

The dispute reached the High Court in 2001, where during a brief public hearing the court was told the brothers shared property assets in Dublin worth €20million with €7million in related loans but were no longer able to agree to work together.

The matter was soon settled privately and Richard – by far the better known sibling – proceeded to become a large-scale developer, launching plans for a new super hospital on the Naas Road in 2007 and completing a number of Limerick housing projects through his company Abbeyrock Developments Ltd.

In a by now all-too-familiar pattern, Abbeyrock was dissolved in February. Receivers have been appointed to other firms owned by Richard and a posse of different banks are pursuing their debts in a string of High Court proceedings.

Hugh, though, appears to have fared better and did not get as involved in large scale speculative development although he did enter an Anglo Irish Bankfunded consortium for the Clarion Hotel on Cork’s Lapp Quay.

After splitting with his brother in 2001, his wife Sheryl – a pharmacist – joined Hugh as a director and owner of Usher’s Quay petrol station holding company, QEC Ltd.

In January 2003 another firm, Rushvard Ltd, through which the brothers had held the Usher’s Quay car park, was sold by Hugh for an unknown sum to multinational firm, Q-park.

Then in 2005 – shortly after he invested in the Anglo Clarion deal – Hugh Farrington sold off a number of Dublin properties, including the Eccles Street property and others in Gardi S P b k R d B l Anglo Clarion deal – Hugh Farrington sold off a number of Dublin properties, including the Eccles Street property and others in Gardiner Street, Pembroke Road, Burlington Road and Charlemont Road. But he retained the petrol station and it remained one of the busiest in Dublin as many other city centre forecourts were closed and sold off for development.

This cash cow was helped considerably by the fact that the Garda fuel contract was with Topaz/Statoil – Farrington’s then supplier – and his was the only available station in Dublin city centre and near to Garda HQ in the Phoenix Park and many city police stations.

So a large proportion of the Garda annual €10million-plus fuel budget was going directly onto the balance sheet of Hugh Farrington and his wife.

The only blip – until now – was the 2007 controversy over his inflated prices and the related loss of the Topaz contract.

But, undeterred, Mr Farrington immediately registered a new business name – One Oil – and traded on. He is now supplied by Top Oil.

But, undeterred, Mr Farrington immediately registered a new business name – One Oil – and traded on. He is now supplied by Top Oil.

Something though was amiss and in recent months the National Standards Authority of Ireland (NSAI) had received several complaints of short measuring at the pumps.

In August 2010, inspectors discovered a ‘significant number of non-compliance issues’ relating to the amount of fuel being dispensed and the price charged.

The Farringtons were instructed to immediately rectify the problems.

But after further complaints, inspectors from the authority’s Legal Metrology Service revisited the premises in February 2011 and discovered that the fuel pumps, which had been rectified, had broken seals and were ‘significantly under-measuring petrol and diesel being sold to consumers’.

This week Mr Farrington’s company was fined €14,000 for the offences and an NSAI spokesman said inspectors had recently revisited the service station and found the fuel pumps were now correctly calibrated.

But there may be other problems ahead.

The company has just been placed on the strike off list by the Companies Registrations Office for failing to file accounts. The 2009 accounts were due to be filed in September 2010 but have not been lodged. The latest available accounts – from 2008 – also highlight some possible accounting issues.

The company reported a loss of €260,000 in 2008 but had cash at bank totalling €266,000. However the auditors, Farrell Grant Sparks, stated that they had been ‘unable to carry out auditing procedures necessary to obtain adequate assurance regarding the quantities and condition of stock appearing in the balance sheet’. The auditors warned that any subsequent adjustment to the stock figure may ‘have a significant effect on the profit of the year.’ They also noted that because of the reported losses the company was entirely reliant on the continued support of shareholders. Whatever about the support of shareholders, in the wake of this week’s prosecution, the Usher’s Quay facility may well find it has lost the support of many customers.