By: Michael O’Farrell

Investigations Editor

DEBT campaign group New Beginning is embroiled in controversy again after one of its experts was recorded advising a client to pay bankruptcy fees with a credit card.

The group is already under investigation after the Irish Mail on Sunday revealed it was selling client data.

The adviser, whom New Beginning says acted without authorisation and against company policy, told the client any extra debt incurred would not matter because ‘we will get our fees but then it will all be written off in your bankruptcy’.

Incurring extra debt in the knowledge it cannot be repaid is a possible breach of bankruptcy laws and the courts can force a bankrupt to repay any transfers deemed to be an attempt to defraud creditors.

Such a transaction could also be an offence under the Criminal Justice (Theft and Fraud Offences) Act 2001. Under Section 6 of the Act anyone who tries to gain financially through deception, either for themselves or someone else’s benefit, can be prosecuted. The Insolvency Service of Ireland last night said: ‘The ISI believes any practice that encourages vulnerable people to deliberately incur a debt which they know they cannot pay is at the very least reckless.’ ‘It is certainly not appropriate for a debt adviser to tell vulnerable people to do this and any such adviser should be reported to the relevant regulator.’

A spokesman for credit card firm Visa Europe said: ‘We take any reports of potentially fraudulent activity extremely seriously and raise them with our member banks and the relevant authorities to ensure they are fully investigated and the appropriate action is taken.’ The client, a single mother of two, who was advised to pay by credit card first made contact with New Beginning by email on March 2 after her bank threatened to repossess her home.

She received a call back from New Beginning’s Jane Carroll the same day. Mrs Carroll and her husband Paul used to run their own bankruptcy advice firm, Neo Financial Solutions Ltd, until they announced a merger with New Beginning at the beginning of this year which resulted in a new firm, New Beginning Processing Services Ltd. Mrs Carroll and the client agreed to speak again the following week to arrange a meeting.

After a subsequent phone call a meeting was arranged for March 11. According to Mrs Carroll that meeting took place at her Howth home because although on a day off she was trying to facilitate a desperate homeowner who could not meet at any other time.

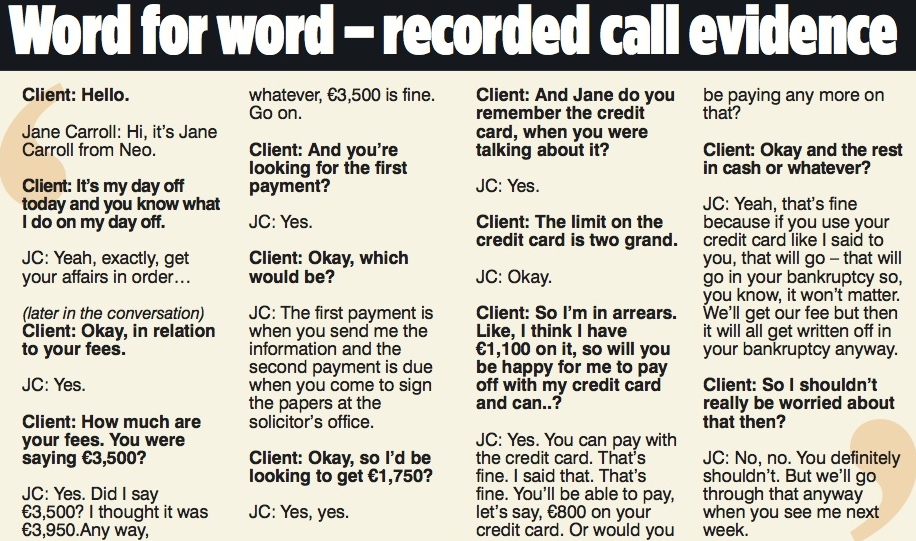

During the meeting the client was told by Mrs Carroll that she could pay by credit card and the subsequent debt would be wiped out by the bankruptcy. This was confirmed in a follow-up call this week that was recorded.

This timeline of events was confirmed by the Carrolls when contacted this week by the MoS.

But as of Friday, March 13, New Beginning and the Carrolls have parted ways with the merger of their two companies breaking down completely in a bitter war of words and counterclaims.

Although the client’s initial email and follow-up call to New Beginning is recorded on the firm’s systems, Ross Maguire said there is no record of the meeting at the Carrolls’s home and the ‘advice she gave was not authorised’. He insisted: ‘It is not our practice to take payments by credit card for bankruptcy.’ But when the MoS contacted Paul Carroll – who until last week headed up New Beginning’s bankruptcy department – he alleged it was New Beginning policy to take credit card payment for bankruptcies.

‘The policy about payment was we received payment by cash, cheque or credit card and that was basically it,’ he said.

Mr Maguire rejected this as ‘completely untrue’ and branded Mr Carroll as ‘outrageous’ to claim it.

The Carrolls are also claiming that New Beginnings owes them money. Mr Maguire insists: ‘New Beginning is solvent and pays its debts as they fall due.’