By: Michael O’Farrell

Investigations Editor in Kiev

THE MoS has tracked down and conducted the first ever interview with a secretive Ukrainian tycoon who is a key figure in the asset recovery battle between the Quinn family and the former Anglo Irish Bank.

Aleksandr Aleksandrovich Orlov, 32, is the beneficial owner of an offshore British Virgin Islands company called Lyndhurst Development Trading SA to which Seán Quinn Jr and Peter Quinn assigned assets worth $45.2m relating to a lucrative Kiev shopping centre.

Because Anglo, which now calls itself IBRC, believes Mr Orlov is helping the Quinns to siphon family resources away from the bank, they have tasked specialist Russian debt recovery outfit A1 with pursuing and recovering the assets.

But Mr Orlov denies any link to the Quinns and is desperately seeking to negotiate directly with Anglo himself – something the bank has so far refused to do.

‘Why can’t the bank sit down with me like you are? We just want the bank to talk to us,’ he said.

The MoS encountered Mr Orlov last Thursday night in Kiev’s fivestar Opera Hotel. He was accompanied by a lawyer holding UK power of attorney, Alex Sapunovas, his advisor Dimitri Zaitsev and a third Ukrainian lawyer.

The UK lawyer coordinating the Lyndhurst case internationally – London-based Alex Tribick – was also present.

By any standards the encounter was extraordinary. It began with neat shots of Ukrainian Nimiroff vodka accompanied by slices of pickled herring and succulent thin strips of salted pig fat and ended with a promissory note worth a cool $4.5m being produced and offered to Anglo.

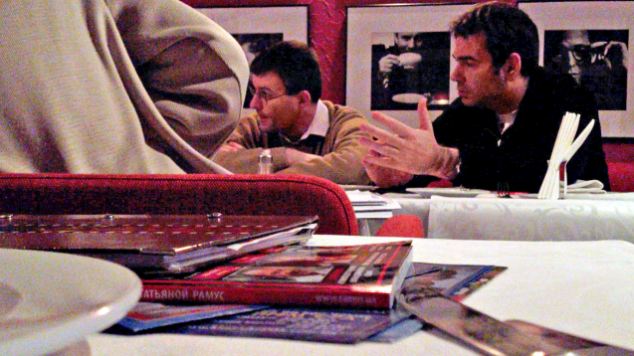

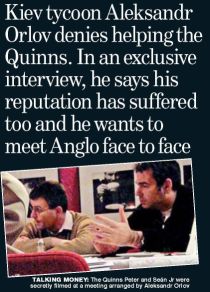

It was Orlov – a stick-thin character with delicate long fingers and tightly cropped hair – who ordered that Peter Quinn and Seán Quinn Jr be secretly videoed as they discussed cash payments at a tense restaurant meeting in Kiev this January. And it was advisor Dimitri Zaitsev who did much of the talking in that video.

The video was first published by the MoS in July and has since been entered into evidence against the Quinns since it records a discussion of cash payments from Lyndhurst to the Quinns.

At the time the secretive Mr Orlov used an intermediary in London to supply the video and did not reveal his identity at all.

Now though – threatened with the arrival of Anglo’s Russian recovery agents – he has been forced out of the shadows for the first time.

Mr Orlov made it clear from the outset that he would not allow any cameras or recording devices of any sort but he did agree that the entire meeting would be on the record, albeit supervised by his team of advisers and lawyers.

What transpired over the next couple of hours has revealed yet more astonishing details about the continuing Quinn saga, as well as providing the very first insights into the man who pounced to buy the right to the debts of the Quinn family’s Kiev shopping mall from under the nose of Anglo Irish Bank.

‘I finished university in Kiev 12 years ago. I have been in business for eight years and along the way I have different businesses in real estate businesses and securities,’ Mr Orlov told the MoS when asked what his background was.

Smartly dressed in a blue tailored suit and tie with crisp white shirt the publicity-shy tycoon sipped slowly from an expensive Russian brandy occasionally smoking thin filter-tipped cigars as he spoke.

‘I used to be very good at playing casino until it was forbidden in the Ukraine. Now I take my risks doing business,’ he said.

Like the prime minister, Mykola Azarov, he is from the Donetsk region of the Ukraine and is married with no children. He says that he is not closely affiliated with politicians though he knows a few.

A ‘golden rule’ for him and many businessmen here is secrecy, he says, by way of explaining his reluctance to come forward into the public eye.

‘If you are not known publicly your business runs smoothly and there are no unnecessary problems.

Once you’re exposed to the public you see a lot of problems. If people know your successes they see opportunities. My privacy, it’s a principle.’

But thanks to his decision to deal with the Quinns, Mr Orlov says his reputation in the Ukraine has already suffered since he has been connected to the scandal in newspaper articles.

‘I first met the Quinns when the manager of the Quinn company that ran the Ukrania mall – Larissa Puga – told us of an opportunity for a deal,’ he said.

‘We first met at the end of September through Larissa Puga. We heard about the shopping centre’s debt issues and we did our own inquiries and decided to get involved.’ For the record, Anglo insists that Mr Orlov and his company, Lyndhurst Developments, is somehow in cahoots with the Quinns as assets are kept beyond reach of the bank and split up among the parties.

But Mr Orlov denies the allegation outright and insists he simply saw an opportunity to make a deal since the Quinns were desperate to get cash for the shopping centre asset.

Mr Orlov said he first met Peter Quinn and Seán Quinn Jr in September 2011 in an upmarket billiards club that operates among a chic cocktail bar, a sushi bar and a micro-brewery music pub on the top floor of the Quinns’ Ukrania shopping mall.

It was in that smoke-filled, dimly-lit room that the deal which saw the Quinns sign over their rights to the centre’s assets began to take shape.

‘We met in the billiards club. There were other meetings but it was here that we generally agreed the basics. They seemed decent people you could do business with.

‘They were anxious to convince us there was no risk to the deal for us. But we knew it was risky. We knew that.

‘Later on they said they were having difficulties with the bank in Ireland but they said this was nothing to do with the Ukraine. They said it was only about the Quinn group but not in the Ukraine.’ Mr Orlov said his lawyer checked and found nothing to prevent the Quinn deal.

‘We did not find anything wrong with the paperwork. The transaction was in the Ukraine only and it was cleared by the Central Bank here.’ Mr Orlov did supply the MoS with sensational details of the financial terms of his deal with the Quinns as well as bank records and receipts which we are endeavouring to substantiate. The Quinns deny they ever received any payments from any Ukrainian even though at least part of their deal – a $100,000 payment in January – was caught being discussed on video.

‘We are not happy with a hundred thousand dollars cash, but we will take it obviously.

‘Is there somewhere for us to put that today?’ Seán Quinn can be heard telling Mr Zaitsev on the video.

Mr Orlov says he decided to secretly video the Quinns when they met his representatives in January 2012 because he was unhappy that they appeared to be reneging on their deal by swearing to the Irish courts that their signatures had been forged.

He says he sanctioned the payment of a final $100,000, as discussed in that video footage, ‘as a kind of gesture’ to see if they would co-operate.

According to Mr Orlov, there has been no further contact since then from the Quinns apart from one email from Peter Quinn.

And now he is anxious to negotiate directly with Anglo.

To that end, Lyndhurst – through its UK power of attorney – wrote to Anglo two weeks ago: ‘We note with surprise and interest what we understand to be your client’s instruction of A1,’ the letter reads.

‘This firm is willing to endeavour to assist in the recovery of assets, which are in focus in these proceedings.’ Lyndhurst’s letter also formally denied any links to the Quinns.

‘For the avoidance of doubt we wish to make it clear that neither this firm nor the writer acts for, nor has acted in connection with, the Quinn family nor their various current and former business interests.’ Anglo has not yet responded and declined to comment last night when asked to comment by the MoS.

But the bank has already shown in court that the right to the Ukrania shopping centre asset has already been transferred from Lyndhurst onwards to other mysterious Ukrainian companies.

In the middle of the transfers sits $45m worth of promissory notes – essentially IOUs secured on the shopping centre and which mature in 2017.

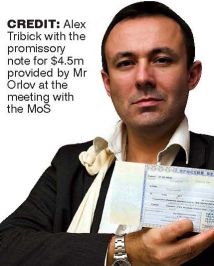

There are ten such notes, each worth $4.5m, which were obtained by Mr Orlov’s company from credit brokers to finance the deal with the Quinns. Now the unknown owners of these new companies possess these 10 promissory notes, but one of them ended up on the table during our interview.

Mr Orlov and Lyndhurst are coming under increasing pressure as a result of legal actions by Anglo. On Tuesday, Lyndhurst faces being made insolvent in the British Virgin Islands (BVI), where it was set up, because it only has cash deposits of $17,000 but owes $90,000 of Anglo’s legal costs which a court has ordered it to pay.

The legal bill was incurred when Anglo first secured an injunction preventing Lyndhurst from moving its assets and had a receiver appointed to the company.

If the costs are not paid tomorrow Lyndhurst will be liquidated.

But what if – Orlov asks – he could get the promissory notes returned to Lyndhurst from those mysterious companies? Then, he says, there would be no liquidation and he could be refunded for any payments and legal costs he has incurred to date. In return, he says, he would deliver the promissory notes to Anglo.

No sooner is the possibility raised than one of his advisors produces one of the promissory notes from a folder. This appears to be a moment they have been waiting for all night.

The long, gilded, stamped and embossed sheet of paper – worth up to $4.5m to whoever possesses it – is slid across the table between silver platters of pickled onions and a crystal carafe of vodka.

There is no explanation as to how it was obtained but the meaning is clear. Where one came from the rest could follow – if Anglo is of a mind to negotiate rather than set its Russian asset-recovery specialists on Mr Orlov a deal could be done.

Since the interview Lyndhurst has this week written to Anglo’s receiver in the BVI indicating that DHL will be used to deliver the promissory note into the hands of the receiver.

‘Clearly, once in receipt of this, the financial position of Lyndhurst is secured, and arrangements can then be made in respect of the discharge of any sum that may be due,’ the letter reads.

To part with a promissory note which is worth millions rather than simply pay $90,000 seems absurd and may well be treated as such by Anglo and its receiver.

But Mr Orlov says he has already spent $900,000 in legal fees and is now happy to part with one promissory note as a final ‘gesture of goodwill to the bank’.

It is presumably unlikely that Anglo would accept such a proposal, given its belief that Mr Orlov conspired with the Quinns to deny the bank its $63m shopping mall asset in the first place.

Whatever the truth, the camerashy Ukranian behind it all claims the ‘truth is on my side’.

‘The Quinns are dodgy,’ he adds in his eastern European accent. ‘This is a very inconvenient position for me. My reputation here has suffered because of my name in the news.

‘I have many problems with this situation. I only want to recover the money I spent.

‘It’s a stupid situation but I am not a man of conflict. I will not kill or fight or smack their noses.

‘I want to resolve all this situation in a civilised manner. I will go to the end to do this if that means the EU courts. I will go as far as I need to go to resolve it.’

And does he have a message for the Quinns? Indeed he does. ‘Give me my money back.’ Funnily enough that’s just what Anglo would say to him.

*******

POSTSCRIPT

Further light was thrown on the mysterious dealings of Lyndhurst in papers leaked as part of the April 2016 Panama Papers expose. Leaked files from secretive Panamanian firm, Mossad Fonseca, confirm that Aleksandr Orlov was – as we reported – the beneficial owner of Lyndhurst from the beginning of its involvement in the Quinn’s Ukrania shopping mall. The leaked papers also show that Mossad Fonseca was concerned about the possibility of being dragged into the legal dispute between IBRC and the Quinns as both sides battled over control of former Quinn assets.

The Irish Times – a member of the International Consortium of Investigative Journalists which oversaw the Panama Papers leak – reported the Mossad Fonseca link on April 6, 2016. Those reports – by Colm Keena – can be viewed at the following links;

Panama Papers firm linked to legal fight over Quinn property

Law firm worried about IBRC legal case over Quinn mall